Written by Derek Melvin

I doubt you found this blog post by accident. If you are a doctor, you likely get bombarded with emails and advertisements about own-occupation disability insurance just about every day.

The most common questions we receive are:

- Do I really need it?

- How much does it cost?

- Is it worth obtaining coverage while in residency or fellowship?

This blog post will give you simple answers and more detailed explanations to these common questions about disability insurance for doctors.

Do I Need Disability Insurance?

If you are dependent on your income, you need long-term disability insurance. It is as simple as that. Have you already bought and paid off your forever home? Do you want to send your kids to college? Could you retire today and never work again? Unless you inherited a multi-million-dollar fortune or won the lottery, you still need your income to save up for your financial goals. Over 1 in 4 of today’s 20-year-olds will become disabled before they retire. It is essential to take appropriate steps in covering your income given the probability of that occurring to you.

Even though you tend to get what you pay for in life, most people (including me) gravitate towards whatever is free and easy. Most residents, fellows, and attending physicians have long-term disability insurance provided to them for free by their employer.

These policies usually cover everyone working at the hospital or at least all the residents/attendings. What is great about these types of policies is that they do not require any medical underwriting and they are usually free. What you probably did not know about the coverage you get for free is that it’s woefully inadequate and likely won’t pay out when you think it will. This article written by Christopher Yerington, an anesthesiologist who was forced to retire due to disability, shows the pitfalls of relying heavily on group disability coverage.

In most situations, free long-term disability insurance provided by your employer defines “disabled” as being unable to perform the duties of any gainful occupation for which you are reasonably qualified. This means that if you cannot perform the duties of your job, but you could still feasibly work in another job earning less, then you would not qualify to receive the disability income. In some cases, it will use an “own occupation” definition of disability for 1-2 years.

This free group LTD (Long-Term Disability) also calculates the monthly benefit based on a percentage of your income (usually 60% or 66.67%) up to a maximum amount. The monthly cap on the benefit varies greatly by employer, so check your benefits to confirm. The payout is also taxable as ordinary income if you didn’t pay for the policy.

Getting individual, own occupation disability insurance gives you protection that pays a tax-free benefit when you cannot perform the duties of your job. Depending on how your applications are approved and structured, these policies can continue to pay you until you’re up to 70 years old.

Physicians especially benefit from having an own occupation definition of disability because of how specialized your work is. Since you went through anywhere from 7 to 13 years of post-graduate training, you have an extremely fine-tuned skillset that is reflected in your duties. Your risk of going on a full or partial long-term disability claim depends on your specialty, but doctors tend to have more complex job duties to perform than the average person and therefore, are more likely to miss time from work due to a long-term disability.

So, is Disability Insurance Worth It?

When you still have decades of income that you have not yet earned and you are still relying on those potential earnings to accomplish your financial goals, that income must be protected. Without accounting for inflation, a 30-year-old who plans to work full-time making $300,000 per year until they’re 60 has $9,000,000 of future income at stake.

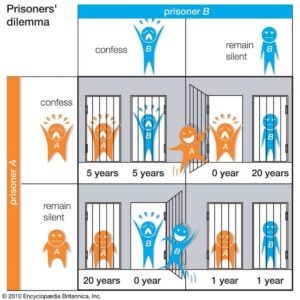

Consider the Prisoner’s Dilemma and how it can relate to disability insurance. In this thought exercise, two individuals acting in their own self-interest do not produce the optimal outcome.

With disability insurance, put yourself in the shoes of prisoner A. Instead of confessing or remaining silent, you have the option to get disability insurance. Instead of prisoner B, you have nature and the powers-that-be determining if you sustain a long-term injury or illness that prevents you from working as a physician.

| You end up needing disability insurance | You don’t end up needing disability insurance | |

| You have disability insurance |

3rd best outcome

Becoming disabled or ill for many years is never good, but at least you can still receive your income. |

2nd best outcome

Great! You made it through your working years and never needed your long-term disability insurance. |

| You don’t have disability insurance |

Worst outcome

Much like in the above example, you (prisoner A) must choose to avoid this outcome. |

Best outcome

In a perfect world, you would never pay for any insurance that you didn’t need and you would never sustain a long-term injury or illness. |

How Much Does Disability Insurance Cost?

A previously published post on the ins-and-outs of structuring an individual disability insurance policy covers this in more detail. For now, just know that the cost depends on a handful of things that you cannot control. Your age, state of residence, occupation/specialty, gender, and health history all play a role in how much you pay for disability insurance. For these reasons, it’s best to apply while you’re young and healthy. Waiting increases your age and introduces the risk that your health could change.

If you would like help screening your options for coverage with an insurance company that offers own-occupation contract language, reach out to us and we can begin looking through which may be the best fit for you.

Should I Get Disability Insurance as a Resident?

From a financial advisor’s perspective, the risks of not getting coverage while in training far outweigh the cost of paying for a policy.

Depending on where you are completing your residency or fellowship, you may qualify for a sizable discount through your training program. Each year that you age, your rates also rise by anywhere from 3-8%. Getting that discount on a policy while you’re young can mean saving thousands of dollars in the long run.

The big risk of waiting to secure a policy is that you experience a change of health and cannot qualify for individual coverage or cannot get the important policy features you want. To go back to the Prisoner’s Dilemma analysis, this is the “worst outcome” that must be avoided.

Summary

For additional independent articles about disability insurance, check out some of our other blog posts on the topic. Feel free to reach out to us with questions about how it works, what’s right for you, and how to find out what a policy would cost you before you commit to anything. We also suggest working with an independent insurance agent that allows you to compare multiple different companies when coming to your decision.

Disclosure

Fixed insurance offered through various independent insurance companies.

Related Blog Posts

- Financial Planning 101: Insurance

- How Much Income Should I Protect?

- Disability Insurance for Doctors

- What to Look for in a Disability Insurance Policy for Doctors