While working through the retirement planning process for doctors, the question, “How much do I need to retire?” comes up quite frequently, and my answer is almost always the same. It depends. To no surprise, that’s actually my favorite answer to almost any financial planning questions.

There is no one-size-fits-all approach when it comes to retirement planning for doctors. Each person is unique and has a different set of goals, lifestyle, etc. That being said, there are some general guidelines that doctors can follow to know what to shoot for when it comes to retirement planning. Let’s dive in!

Listen Here!

First Steps: Project Expenses in Retirement

First things first, it will be helpful to project a rough idea what your desired lifestyle and expenses will be like in retirement. That’s the most important piece to determining how much money you need to retire as a doctor. Expenses will change over time.

Changes in Expenses Over Time.

Early in retirement, assuming you are healthy and able, you will likely spend more money on travel and entertainment. As you age, traveling and going out of the house in general will become more cumbersome, so naturally some of your expenses will decrease. Towards the end, assisted living costs could be a huge expense, so planning for those is helpful.

Some of the obvious expenses are going to be housing costs, food, utilities, transportation, insurances, entertainment, travel, and possibly gifts/charity. Don’t forget taxes. Any money withdrawn from pre-tax retirement accounts is taxed as ordinary income. Investment earnings are taxed at capital gains tax rates. And even if you own your house outright, you will still owe property taxes on your house.

Depending on the path you are on, you may have some debt payments present (mortgage being the most likely one). It’s also smart to factor in a buffer for unexpected expenses.

Most doctors want to live a similar lifestyle in retirement to the life they grow accustomed to living while working. If you fall into that camp, you can probably take all of your current expenses and cross off a few that (hopefully) won’t be present in retirement.

Questions about retirement? Please reach out to us and we would be glad to schedule an initial meeting to learn more about your financial situation, goals, and ways to improve yourself moving forward.

Expenses That May Be Eliminated in Retirement

Some of the big expenses that will likely be gone or should be gone by retirement are:

- Mortgage

- Student loan payments

- Childcare expenses (including school tuition payments).

- Disability Insurance premiums – no longer need to protect income if you’re retired. This could be upwards of $1,000/month for some doctors.

For some of you, these expenses could amount to over half of your current monthly expenditures! Some of the existing expenses may be replaced with increased travel and fun in retirement. Those greens fees can start to add up!

If you plan to retire before age 65, you will need to pay for private health insurance out of pocket until Medicare kicks in, which won’t be cheap (probably at least $1,000/month for a couple, if not per person).

Do Not Over-Analyze When Projecting Expenses

We don’t want to overcomplicate things, though. No need to analyze year by year what your anticipated expenses will be under evolving circumstances. We want to make this is as simple as possible. Therefore, add up all the expenses you anticipate having in today dollars and that’s what we’ll base our projections on.

Financial planning for retirement is a giant guessing game, so don’t worry about precision for this exercise. There are so many variables that are constantly changing, it is impossible to make precise projections. If we’re trying to get a ballpark estimate, we’re not worried about decimal places. We can refine things after we have a rough idea of where we want to go. As a surgeon you don’t start with a scalpel – you start with a Sharpie and mark the area where you will be operating.

If you would like to speak to one of our independent financial advisors regarding your financial plan, please contact us and we would be glad to setup an initial meeting.

The Rule of 25

The simplest retirement rule of thumb I have come across is the rule of 25. Take your annual spending number that you estimated earlier and multiply that by 25. As a doctor, that’s how much you likely need in order to achieve financial independence and potentially retire.

This, of course, doesn’t guarantee your money will last forever. However, if you run a bunch of simulations, more times than not the money will last longer than you will. If you are retiring in your 30’s or 40’s, you may want more than 25x your annual spending to play it safe. In your 50’s or 60’s though, you’re probably in good shape.

Do Not Forget About Inflation

One caveat to this is inflation. If you are 35 years old today, cost of living is likely going to double by the time you turn 60. If you estimate you need $150,000 per-year in today dollars to support your lifestyle in retirement, you will need $300,000 per-year when you are 60 years old to provide that same lifestyle.

That means the $3.75 million in today dollars you need to be financially independent ($150,000 x 25 = $3.75 million) will really be $7.5 million if you are aiming to retire at age 60 and cost of living doubles with inflation.

If you are 35 now and want to live on $300,000 per-year in today dollars in retirement, you will likely need to accumulate $15 million 25 years from now in order to retire at age 60. Easy math.

Where Are You at Now?

Some doctors reading this may be close to their target retirement savings number already! Other physicians may be feeling a pit in their stomach at this moment. If you are the latter, it’s important to remember that you need to sacrifice for what you want in life.

You put in a lot of hard work and made sacrifices to become a doctor. You also need to put in some hard work and make sacrifices if you want to be financially independent one day.

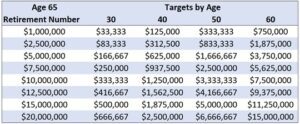

I put together a table of retirement savings targets by age to give people an idea of where they should be at various stages in life. The path to the finish line is not linear.

If you would like help in assessing where you are at in reaching your retirement goals, please reach out to us and we would be glad to schedule an initial financial planning meeting to answer any questions you may have.

Devise a Retirement Strategy

Many doctors don’t even start their first real job until they are over the age of 30. That is why it is imperative to make saving for your future a priority early. I have coached physicians to invest at least 20% of their gross income for retirement. If you are getting a later start and don’t start saving until closer to the age of 40, that percentage should be more like 25% or greater.

If you can get in that habit, that should put you on a healthy track to be able to retire by your mid-60’s and live a comfortable life in retirement, similar to the lifestyle you grew accustomed to living while working. No guarantees of course. Obviously the more you save, the greater the probability of success.

Not everyone wants to retire in their mid-60’s, so the percentages and rules of thumb must be adjusted for each individual.

Are You Saving Enough?

In our podcast interview with Physician on FIRE, he recommends investing half of your take-home pay to get on a fast track to financial independence. If you can do that from the start, you have a good chance of becoming financially independent within about 15 years of entering practice.

Subscribe to Financial Clarity for Doctors on your favorite podcast app to be the first to hear the conversation when it’s released.

Retirement Plans for Doctors

At a minimum, physicians should be maxing out the available tax-advantaged retirement plans available to them. Therefore, you need to make sure you are saving enough to reach your goals.

There are numerous retirement plans for doctors, yet not all doctors will have access to all of them. Most physicians will have access to a pre-tax retirement through their employer (or can establish one themselves if self-employed).

A Backdoor Roth IRA is also a viable option for most doctors and their spouse, although it can create some tax headaches if certain rules aren’t followed. Beyond that, the options for investing are wide open. You will need to save more in addition to those two accounts if you want to have enough money to retire one day.

The specific accounts utilized, and the specific investments within the accounts matter far less than the amount saved on an ongoing basis. The amount you save and the discipline to stick with a consistent strategy over time will have a much greater impact on your long-term results.

Take Action

As mentioned, the best thing you can do to set yourself up for retirement is to simply save more. For a lot of people, this takes someone to hold them accountable and to help with retirement planning. This is a lot like meeting your fitness goals – it is a lot easier when you have a trainer to keep on you every step of the way.

If you feel talking to a professional about your financial plan, budget, retirement savings accounts, or anything else you have questions on would be helpful, please reach out to us and we would be glad to touch on these items as it relates to your specific situation.

Related Blog Posts:

- Retirement Plans for Doctors

- Financial Planning for Physicians

- Retirement Savings Targets by Age

- 5 Steps to Achieving Financial Independence

- Disability Insurance for Doctors: How Much Income Should I Protect?

- Retirement Planning for Doctors: How Much Do I Need to Retire?

Investing involves the risk of loss, including total loss of principal. This should not be construed as individualized investing advice. Consult with your investment advisor to develop an appropriate investment strategy for your circumstances.