Welcome to the second installment of the recommended financial reading list! For those of you that read the books on the first reading list I put together, these ones will serve as a nice follow-up to those. Some of these books are a little more technical in nature than the first set and will give readers more insight to their finances. Add some of these to your 2018 reading list!

Thinking, Fast and Slow

This book, authored by the Nobel Prize winner in economics, Daniel Kahneman, essentially summarizes the research he did with his late colleague, Amos Tversky. They are two of the pioneering economists to delve into the world of behavioral economics and their research proves that the decision making of humans can be less than stellar.

The premise of the book is about how our brains are comprised of two systems. System 1 and System 2, as they call it. System 1 is the fast acting, instinctive system. This is the system that causes you to duck if a ball is thrown at your head. You react without even thinking.

System 2 is the slower problem solving system that requires effort. This is the part of the brain that enables you to calculate in your head what 12 + 27 equals, among other things.

The problem is, sometimes system 1 gets in the way of system 2 and we rely on our instinctive system to jump to conclusions too quickly. This can cause problems for us, especially when it relates to our personal finances. We often make emotional, reactionary decisions when it comes to money, rather than logical decisions that are well thought out.

This book is very detailed and scientific and almost every word has relevance, so make sure you are awake and alert when you start reading, otherwise it might put you to sleep!

Nudge

This is the first of two best-selling books by Kahneman & Tversky’s fellow behavioral economist, Richard Thaler and his co-author & Harvard professor, Cass Sunstein. Their research dovetails on the work by Kahneman and Tversky, but focuses more on personal finances and macroeconomic issues.

Thaler has quite the sense of humor, so his writing is easier and more enjoyable to read, in my opinion, than the first book on this list. However, if you want to learn about behavior economics from the beginning, Thinking, Fast and Slow is where you want to start.

This book talks about how humans are inherently lazy and often fail to make proactive decisions that can benefit them. They will usually take the path of least resistance. Thaler and Sunstein propose ways in which governments and employers can nudge people in the right direction to help lead them to make better choices.

One example is with company retirement plan enrollment. When employees are automatically enrolled in their company’s retirement plan with a default contribution rate (say 6% of their salary), almost 100% of employees participate in the retirement plan. When enrollment in the retirement plan is not automatic and employees have to register and enroll themselves, less than half of company employees will participate in the retirement plan. So, in order to get people to save more for retirement, companies should make enrollment automatic.

Misbehaving: The Making of Behavioral Economics

This is the second book by Richard Thaler, which was published shortly before he won the Nobel Prize for his work in the field of behavioral economics. This book builds on the topics he covered in Nudge and discusses ways in which we as individuals can work to improve our behavior to better ourselves from an economic standpoint.

Most economic models are built around the assumption that humans make rational decisions, always. In reality, humans are…well…human. We don’t make rational decisions. So economic models don’t always work.

In a world where everyone makes rational decisions, “sentimental value” wouldn’t exist and people would never overpay for something. Everything would be exchanged for a fair price, always. Nobody would ever extend themselves beyond their means. Bubbles and busts wouldn’t exist. Stock prices would never skyrocket one year and crash the next. Heck, we wouldn’t need credit bureaus or regulations, because people would only borrow what they can afford to repay when buying a house and banks would only lend appropriate amounts to borrowers.

Unshakeable: Your Financial Freedom Playbook

This is essentially the CliffsNotes version of Tony Robbins’ book on my first reading list, Money: Master the Game. He basically cuts his first book down to one that is about 40% the size, which is much more digestible for most readers.

It is a good book that summaries how most people should go about structuring a financial strategy for themselves. Most of his recommendations and suggestions I agree with, yet you can never take a blanket approach when it comes to financial recommendations. Each individual is unique, so not all of his recommendations will be 100% appropriate for everyone. He also is in the business of making money for himself, so some of the stuff he writes is to appease the masses, appeal to the broadest audience, so he can sell the most books.

The Number

I debated including this book on a recommended reading list. I’m sure there are some investment professionals out there who are thinking, “What is the matter with you!? You are going to scare clients away from investing if they read this book!”

This book, authored by Alex Berenson in the early 2000’s, details the one number that everyone in Wall Street focuses on: Quarterly Earnings Growth. He looks at it from a negative viewpoint and hypothesizes how publicly traded companies are more focused on their quarterly earnings growth than anything else and will do whatever it takes to show growth on paper (see Enron). Companies live and die by their quarterly earnings and their stock price is dictated by the quarterly earnings growth they report every three months. He goes on to further claim that Wall Street is in on the heist and analysts set their expected targets so they can be hit, which means everyone is happy and the analysts will receive their big bonuses. They rarely put a “sell” recommendation on a company, as that would be bad for business.

The reality is not quite as far-fetched, in my opinion. Yes, companies might execute some perfectly legal manipulation, if you will, to meet analysts’ expectations and maintain their stock prices from quarter to quarter. However, the long-term success of a company ultimately comes down to fundamentals. Are you profitably selling a good product and/or service? Simple as that.

Rather than trying to scare people away, I think this book emphasizes what I preach to my clients all the time. Short term results are unpredictable and investing in stocks with a short-term time horizon in mind can be a dangerous game. One bad quarter can hammer the stock price of an otherwise high-quality company. But if the company is a solid company, they will ultimately rebound and prevail in the long-run. So it is really important to invest in vehicles that are appropriate for the time horizon of the investment. If you are investing with a long-term time horizon in mind, then who cares what a company’s quarterly earnings growth is! That is only three months out of a 20, 30, 40, maybe even 50 year time span you will be investing.

Like Warren Buffet says, you should only invest in stocks if you would be perfectly happy to hold them if the market shut down for ten years. “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

There You Have It!

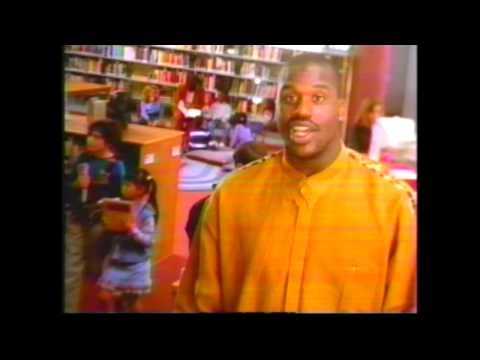

I hope you enjoy these books as much as I have. Like Shaq used to say in those commercials from the 1990’s, reading is FUNdamental.

Link: Shaq

As a side note for those basketball fans out there – look how young Shaq looked back then!

Happy reading!